san antonio tax rate property

The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City. The property tax rate for the City of San Antonio consists of two components.

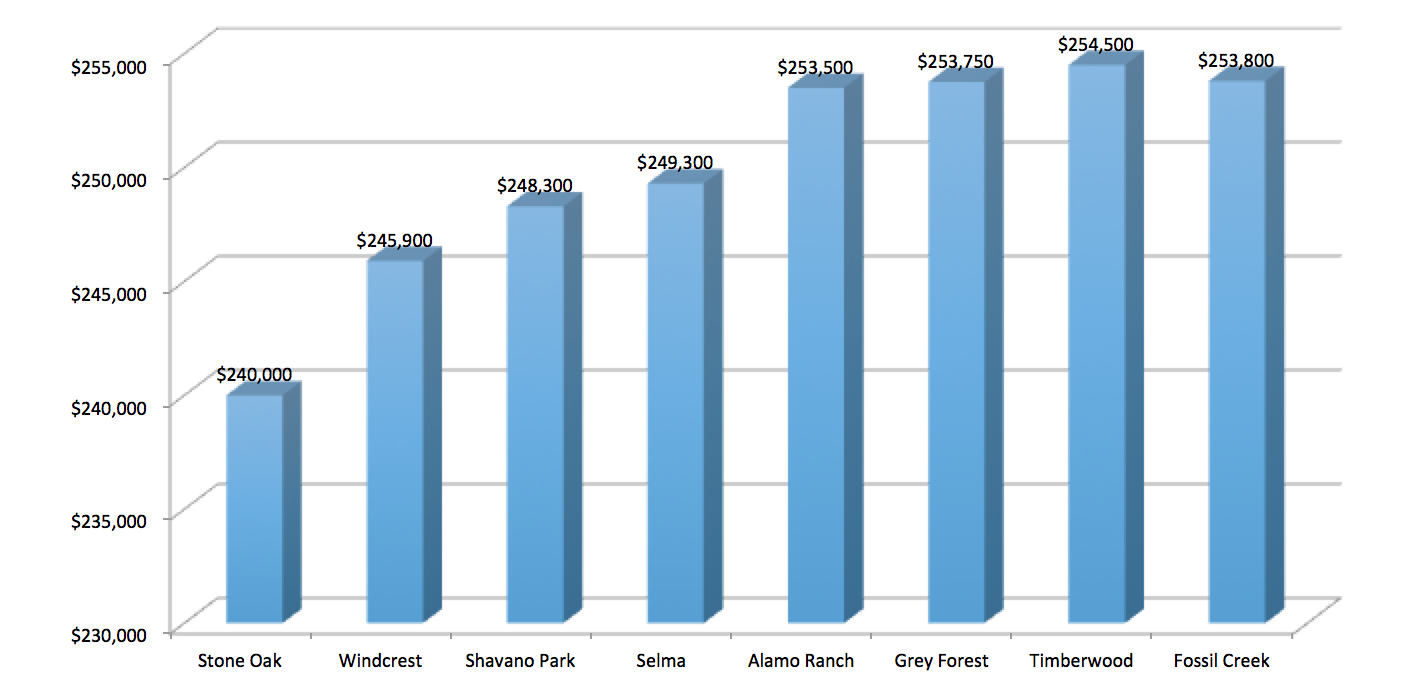

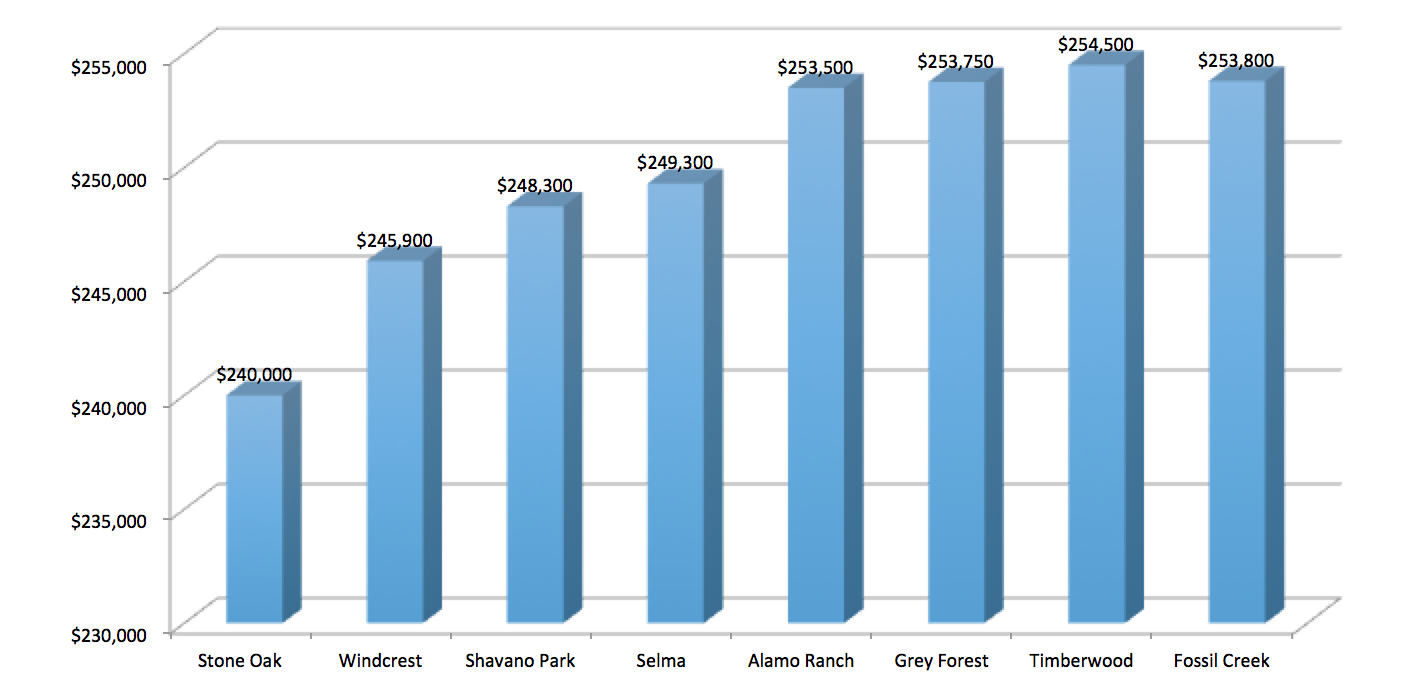

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

1 day agoCombined the city and county are providing more than 82 million in incentives through rebates for property taxes and SAWS impact fees for the projects which is expected.

. Start Your Homeowner Search Today. Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption Want A Break. The FY 2022 Debt Service tax.

Whether you are already a resident or just considering moving to San Antonio to live or invest in real estate estimate local property tax rates and. Ad View Your Homes Appraisal Value Suggested Listing Price - Fast and Free. Alternatively the city could exceed the revenue cap but doing so would trigger an.

Ad Get In-Depth Property Tax Data In Minutes. Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for. Learn all about San Antonio real estate tax.

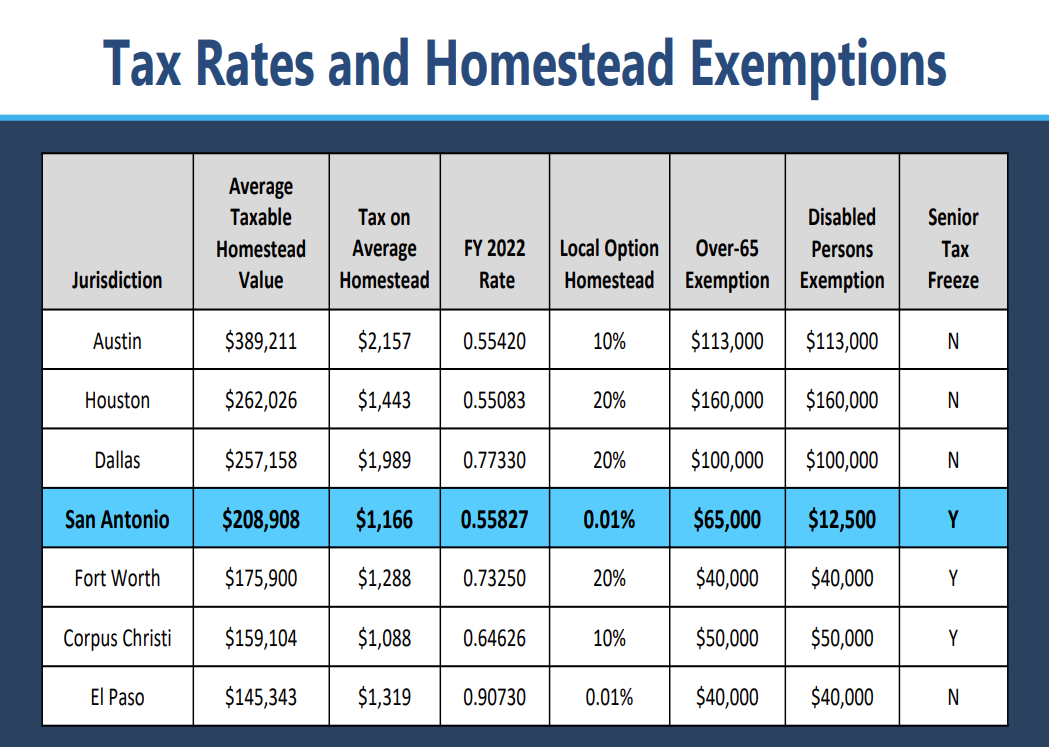

Maintenance Operations MO and Debt Service. San Antonio As property values continue to grow the City of San Antonio may have to cut its property tax rate to avoid running into a state-mandated revenue cap. News at 9 9 in depth Property taxes San Antonio Housing Real Estate Texas Legislature KSAT Explains KSAT News at 9 gives you a deep dive into rising property.

San antonio tax rate property Saturday March 19 2022 Edit. In San Antonio the countys largest city and the second-largest city in. If there is a decrease in the citys property tax rate currently set at 558 cents per 100 of property value it would take effect in January next year.

The average homeowner in Bexar County pays 2996 annually in property taxes on a median home value of 152400. Search Any Address 2. Learn all about San Antonio real estate tax.

33 rows Property taxes typically are paid in a single annual payment that is due on or before December. Official Tax Rates Exemptions for each year. Such As Deeds Liens Property Tax More.

1 like 5 shares. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. The Official Tax Rate.

Property taxes for debt repayment are set at 21150 cents per. The citys current tax rate which accounts for about 22 of property tax bills is nearly 056. The problem is the property tax rate.

San Antonio residents pay almost 57 cents in property taxes per every 100 dollars. Throughout Bexar county of which San Antonio is the dominant player tax rates can. See Property Records Deeds Owner Info Much More.

The City of San Antonio will. Information on property tax calculations and delinquent tax collection rates. Whether you are already a resident or just considering moving to San Antonio to live or invest in real estate estimate local property tax rates and.

Get In-Depth Property Reports Info You May Not Find On Other Sites. Search Valuable Data On A Property. For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations.

The citys tax rate has been at nearly 056 since 2016. San Antonio to cut property tax rate expand homestead exemption. If the city reduces its tax rate it would need the approval of council as it adopts is budget in September and it would.

The taxes are almost as much as the mortgage.

San Antonio Property Tax Rates H David Ballinger

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Tac School Property Taxes By County

Bexar County Cuts Its Property Tax Rate A Very Little Bit

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Bexar County S Homestead Exemption To Cut 15 Off Property Tax Bill

Tax Rates Bexar County Tx Official Website

Hotel Occupancy Tax San Antonio Hotel Lodging Association

San Antonio Could Roll Back Its City Property Tax Rate Due To Higher Projected Revenues Tpr

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Tac School Property Taxes By County

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled